Crystalline OEM Longtou Taiwan announced the revenue status in July 2025, with the revenue amount being NT$323.166 billion, an increase of 22.5% from the previous month and 25.8% from the same period in 2024, which is the second highest record in hi...

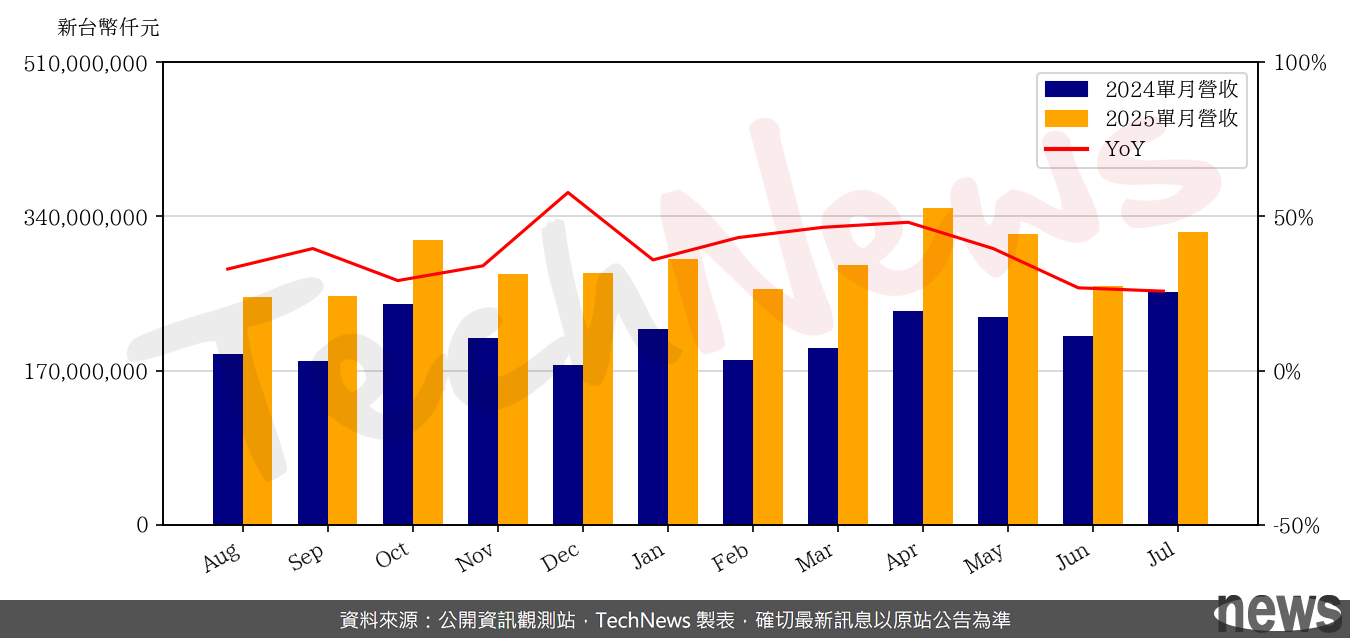

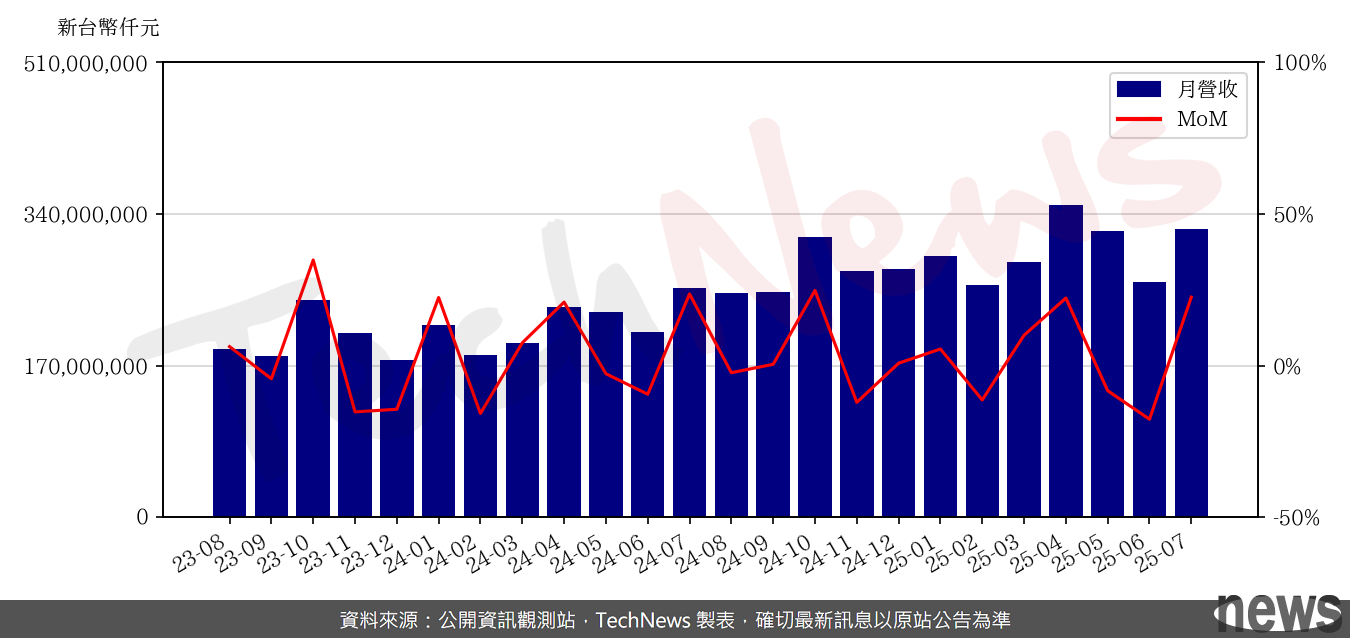

Crystalline OEM Longtou Taiwan announced the revenue status in July 2025, with the revenue amount being NT$323.166 billion, an increase of 22.5% from the previous month and 25.8% from the same period in 2024, which is the second highest record in history. According to the cumulative amount, the revenue from January to July 2025 was approximately NT$296.211 billion, an increase of 37.6% compared with the same period in 2024, which is also a record high in history.

According to the last French conference, Taiwan Electric's outlook for the third quarter, the amount of USD is 31.8 billion to USD 33 billion. It grew by 8% in the previous quarter and 38% in the same period in 2024. At a exchange rate of $1 to $29, the revenue from around $922.2 billion to $95.7 billion is still growing compared to the second quarter. The gross profit margin is 55.5%~57.5%, which is slightly down from 58.6% in the second quarter of 2025. The operating rate of interest is 45.5%~47.5%, which is also lower than the previous quarter of 49.6%.

Trump plans to charge 100% tax on chips and semiconductor courses, but as long as the company promises to produce locally in the United States, taxes will be exempted even if the factory has not completed or even has not yet been completed. However, there was no action after the promise, and the US government would calculate all the accumulated tax and request to pay it. In this regard, formerly a well-known foreign analyst, Shuxingzhi, said on his Facebook fan that Trump has been raising 100% of the semiconductor taxes since the selection. Today, he said that it will be implemented, but don’t be afraid. Apple, the most affected Apple and Taiwan Telecom, look like a bad news after the negative news. The main reason is that Trump has some exemptions, and local consumers in the United States account for 30%+ or -5% of the global semiconductor demand. It cannot be counted as 75% of the US customers of Taiwan Telecom as 100%. Tax scope is because many US customers of Taiwan Power sell more than half of their semiconductors to non-US countries.

Transportation also mentioned that Bloomberg News said that as long as Apple has promised to move the mobile phone production line back to the United States, even if it has not invested in production in construction, it will not have to pay 100% semiconductor taxes, so Kuck announced today that he would invest $100 billion in the U.S. in a circular office in White House and Trump Lima today (previously announced a 50 billion plan for 4 years, and now it has accumulated 6,000 yuan. NT$100 million investment), which means that although NT$100 million is not ready to meet the needs of US consumers in the state of Arizona, NT$100 million is tax-free for Apple's semiconductors.

In addition, foreign broker Morgan Stanley (Morgan Morgan) said in its latest report that Telco still retains a plan for capital expenditure of US$165 billion in US businesses by 203. Due to this investment commitment to the United States, Telco is expected to receive a waiver or a broad deadline for US semiconductor taxes, which is better than what most investors originally worried about. Therefore, the "coded" rating is maintained for NTD, with a target price of RMB 1,388.